Historically, over the very long term, investing in value stocks has delivered better returns than investing in growth stocks (MSCI defines value as stocks which are cheap based on price-to-earnings, price-to-book and dividend yield metrics, relative to the market). The idea is based on the fact that investors tend to overpay for exciting new growth companies and often these companies fail to meet their high expectations, while underestimate the ability for cheap value stocks to recover.

The recent weak performance of the time-tested value investing strategy is particularly challenging. In the past, investors may have seen value stocks as unusually risky, so they built an extra discount into prices to account for that. When the companies did better than expected, the cheap prices outperformed. But once value investing became more and more mainstream, that discount may have gotten smaller, so the stocks had less room to rise.

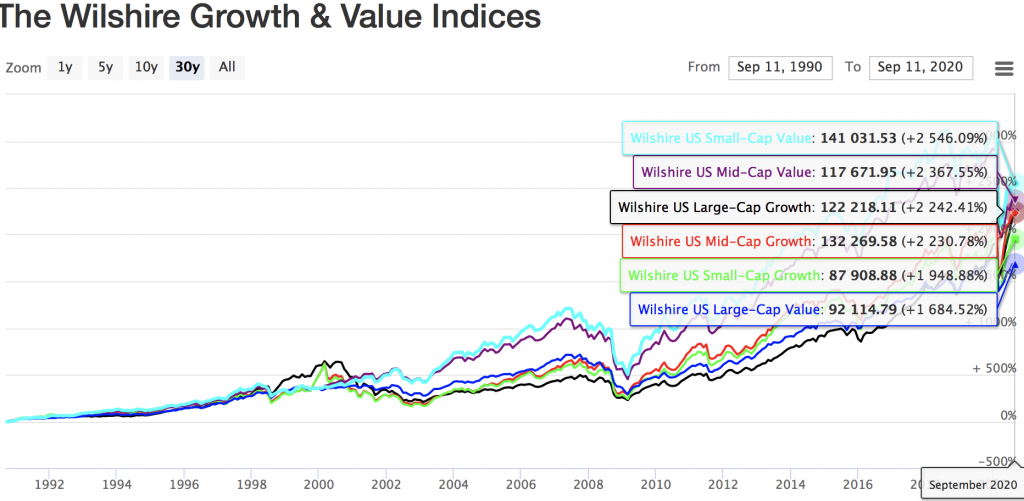

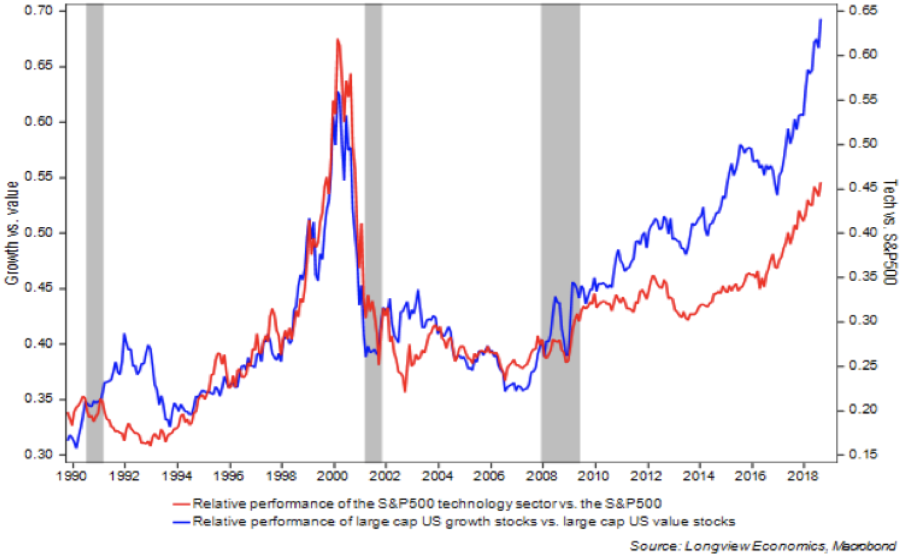

The 2008 credit crisis revealed a profound crisis in value investing since in the recent years large cap growth have taken the lead. Some argue that growth has outperformed value because the Fed keeps pumping money into the system. Typically, quantitative easing (QE) uplifts a depressed economy thus investors see it as a sign of better upcoming market conditions and buy the stocks expecting growth in the markets. Value proponents have blamed various reasons from interest rates to index funds to antitrust regulation. Many blame excessive private market valuations and FAANG stock euphoria. Yet even accounting for growth stock’s recent significant outperformance, value stocks have still outperformed over the longer-term period here illustrated over the past 30 years (’90-’20).

That does not mean that there weren’t shorter term periods within the long run when growth outperformed value. There have been short term periods of 2 to 5 years where growth took the lead such as ’90-’93, ’95 to ’00 (the infamous dot-com bubble) and ’09 to ’13. Due also to the momentum factor that is observed in the short-term growth can outperform value in brief time periods.

RELATIVE PERFORMANCE SUMMARY

Best performance the past 30 years:

Small cap value +2470.22%

Wort performance the past 30 years:

Large cap value +1589.5%

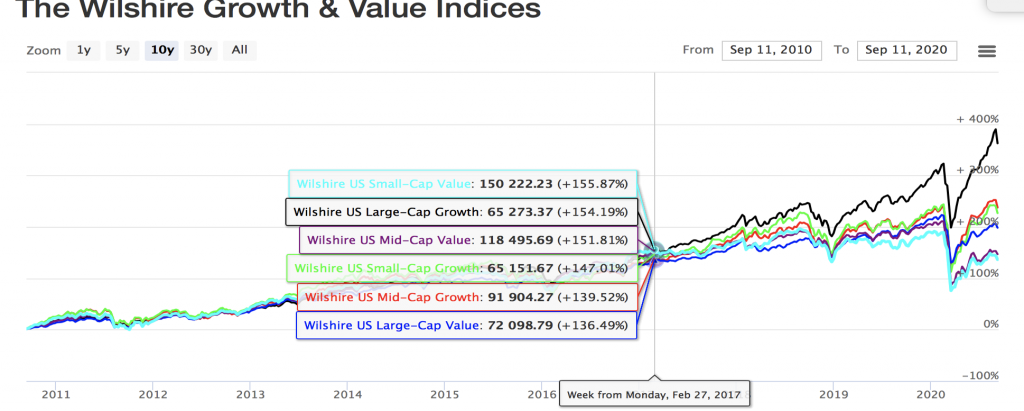

Best performance the past 10 years:

Large cap growth + 362.38%

Wort performance the past 10 years:

Small cap value +136.2%

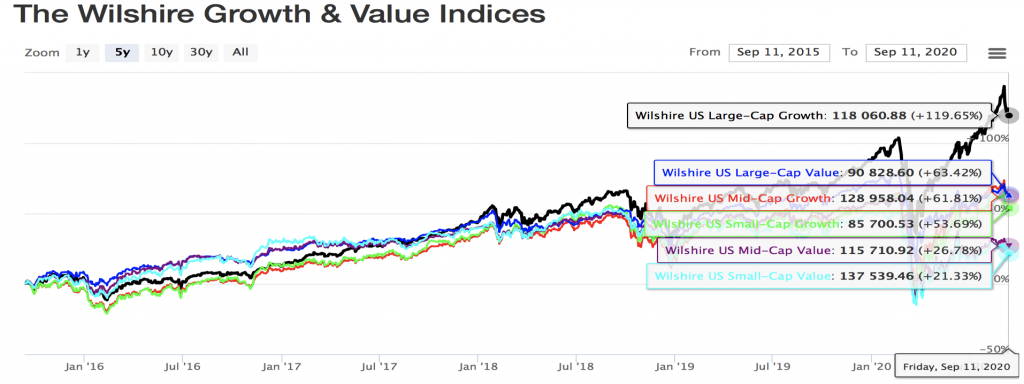

Best performance the past 5 years :

Large cap growth + 120%

Wort performance the past 5 years:

Small cap value +21.33%

Recently large cap growth started consistently outperforming small cap value in 2017 (although small cap value had previously outperformed for some time after 2009), shown by the ratio growth/value. When the ratio is larger than 1 growth outperforms, illustrated every month of each year.

Value stocks sharply underperformed growth stocks from 2017 to early 2020, exacerbating a longer period of weak performance that dates back to the Global Financial Crisis for some value factors, due to the financial sector stocks getting particularly hit.

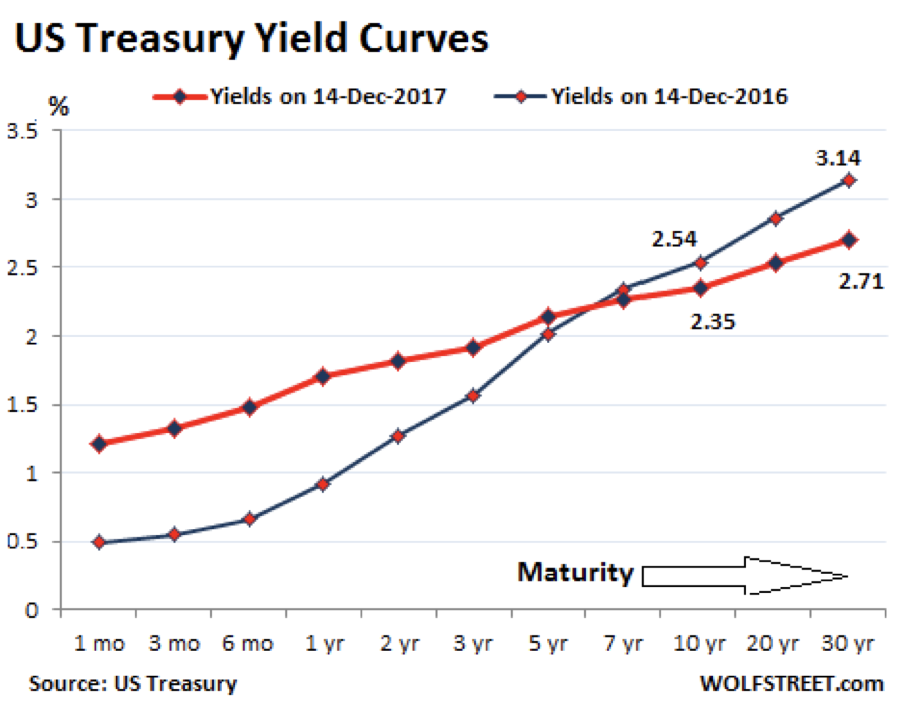

Some have blamed the low level of interest rates or the flattening yield curve, which will be discussed below.

Over the past 5 years, it became evident that “growth” started significantly outperforming since the end of 2017.

2017: Flattening of the yield curve, Financials (XLF) performance, Growth clearly takes the lead

From the period 2011 to 2017 small cap-value had a similar performance with large-cap growth. Then large cap growth significantly outperformed. Financials are the largest part of the value index, whereas technology stocks make up the largest part of the growth index. So, a large part of the underperformance of value stocks since 2007 could be due to the financial crisis of 2008 and the low interest rate environment that has persisted since.

Relative performance Value vs Growth and the 10 year rate

(During the strong-growth period of the Clinton years, when inflation averaged 2.5% and real growth averaged 4%, 10-yr yields averaged more than 6. Currently the 0.69% 10-yr yield shows that we are in a slow growth period.)

Interestingly, during those periods of outperformance by growth stocks, the economic environment was one of falling long term interest rates. Falling bond yields should increase the valuations of growth stocks since those tend to be valued using long term discount factors (low rates favor technology growth stocks that tend to borrow long term). Based on the time value of money, if interest rates are high, the cash flow is worth less in the future, yet with low rates cash flows should be worth more in the future. Growth stocks are desirable the current environment as they get a lot of more of their cash flows in the future compared to value stocks. Conversely, banks borrow short term and lend long term, benefitting from the upward shape (the steeper the better) of the yield curve. Higher interest rates often benefit financial stocks, and therefore also support value investing. Similarly, insurance companies that get most of their profits from investing premiums generating interest income (most insurance company investments are fixed-income), can benefit from rising rates.

Some value stocks can serve as a hedge against inflation and rising bond yields that typically follow. Value stocks that usually pay dividends belong to companies not harmed by the inflation process (utility companies, food producers, staples) and, as such, able to protect earnings growth and dividends in a rising bond yield environment, leading to better performance. In fact, in that low high-income dividend stocks’ and ETF’s relative performance has also been lagging. Rising commodity prices have also historically tended to coincide with the outperformance of value stocks.

The slow economic and loan growth, and low interest rates and commodity prices have held back both energy (that also tend to be dividend payers) and financial stocks, that account for value’s underperformance.

Financials bounced back after the 2009 crisis then technology (FANG) picked up the growth. The XLF has not performed well and stayed flat since 2017 and the XLE has performed terribly since 2018.

Thus, according to JPM, if we remain in this “slow and low” environment, growth stocks may continue to outperform.

If the economy is only growing 2% in a year but a company is growing by 5% or more, it evidently becomes desirable.

However, in either a recession or a reflation scenario value stocks could outperform.

Concerning financial stocks, both net interest margins and loan growth have been low relative to the past. Post-crisis regulation has increased capital levels, improving financial stability but reducing banks’ return on equity.

The Financial Select Sector SPDR Fund (XLF), currently priced at 24.8, has remained flat and has not surpassed the price level of 29.7 since the end of 2017. In particular the flattening of the yield curve around 2017 could account for the weaker net interest margins. There was also a slight inversion in the middle of 2019 that had spread recession fears.

The energy sector has underperformed recently in the financial markets due to a decline in the price of oil. The trade war between China and the U.S and concerns over a potential economic slowdown around the world have contributed to that. However, the main problem is not in oil demand, as much as in excess supply. Oil production used to be reserved for the Middle East, while other countries such as the U.S. have become major producers. Alternative sources of energy such as electricity also pose into question the future growth of the sector. It is estimated that by 2050, electricity will account for a quarter of all energy demand. It has been claimed that the global oil demand will drop from 100 to 70 million barrels per day by 2030.

While the outperformance of technology over financials has been key to the outperformance of growth over value, other sector disparities have been important drivers of value’s underperformance too. Growth has a much larger exposure to consumer discretionary stocks than value and value has a much larger exposure to energy stocks than growth.

The main reason for growth’s outperformance is technology.

The difference in the 10-year return Nasdaq and S&P 500 is really impressive, with an outperformance of 252.4%:

Many view value stocks’ long period of underperformance as merely a painful side effect of the decade-plus-long rally in growth stocks pushing stock valuations high, with the tech giants leading the way.

A prime example is the FAAN(M)G stocks which were considered extremely overvalued for some time. It is noteworthy that those tech leaders do not account only for growth’s outperformance, but have been the driving force behind the whole US economy. Big tech is the reason the US has outperformed other countries around the world. Take out Apple, Amazon, Alphabet, Facebook, Netflix and Microsoft and the S&P 500 doesn’t even outpace the world index substantially.

So the question is can the tech stocks meet up their expectations?

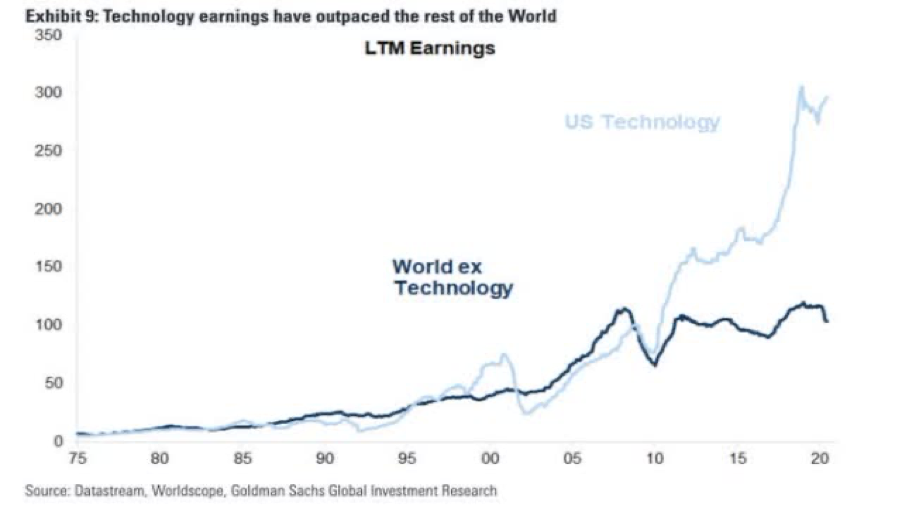

The Nasdaq has outperformed the S&P 500 by a wide margin in every possible time frame since 2010, yet the huge earnings growth of tech companies since 2010 justifies the huge outperformance, exhibiting high growth for years in a row and high gross margins. Moreover, major tech companies do not have much competition in their field and we do not see a dotcom-like bubble, when all internet start-up companies were rising simultaneously.

An example is when Nikola showed up in the market as Tesla’s competitor, it took some market share from Tesla (whose price significantly fell), indicating that there isn’t a tech pricing folly, such as in the case of the small and rival internet companies that were appreciating altogether (not as stretched in terms of the share of total market cap).

The projections for cloud spending indicate tech investment growth longer than the next five years, meaning that long term investors are not too concerned about present valuations. The high multiples often come down very fast because a lot of tech companies grow their sales very fast. Technology has proven to be indispensable, especially during the time of the pandemic. Digitalized workspace and communication services are becoming more and more a necessity. A lot of operations are focused online and to the cloud (also 5G investments). Today, advertisers spend more than four times the amount online than in newspapers and applications such as Facebook, Uber and Tweeter are more and more essential to everyone (not just a fad).

Tech earnings have indeed exceeded other sectors.

Change in the way of investment of corporate assets and the effect of traditional accounting practices

Many think the stock market is expensive today because of the PE multiples. Yet according to Brad Neuman, senior vice president and director of market strategy at growth investment firm Alger “The stock market is actually cheap on a price-to-free-cash-flow basis.”

Neuman argues that the traditional ways investors classify which stocks are cheap and which are expensive is not as accurate as business practices have outpaced U.S. accounting standards.

“There’s been a dramatic change over the past several decades in how companies invest. Historically, when companies invested, most of their assets were tangible assets while today they invest more in intangible assets, patents or intellectual property, for example, that aren’t accounted for in the same way that tangible assets are. “Intangible assets are expensed, not capitalized, which means they don’t show up in book value,” Neuman notes.

This inherent flaw in book value and, relatedly, earnings has been attracting a lot of notice in academic circles trying to explain value’s underperformance.

Is a reversion to the mean due?

Value stocks today are trading at a much larger discount than they have in the past and have stayed cheap as growth stocks keep growing. Many point out how cheap value stocks currently appear in comparison to growth stocks, especially the so-called FAANG companies: Facebook, Apple, Amazon, Netflix, and Google.

As investors extrapolate the past and expect stocks that have delivered fantastic growth in the past to continue to do so in the future, the gap in valuation between growth stocks and cheaper value stocks increase. Today, the gap between the price-to-earnings ratio on growth and the P/E ratio on value stocks is higher than it has been 97% of the time since 1975, and is the highest since 2000.

Meanwhile many asset managers who’ve adopted factor investing (“smart beta’’), statistically tilting their portfolios to stocks with certain characteristics, many of which lean toward value, are expecting a value recovery. Smart beta investing is becoming increasingly embraced with many fundamental indices systematically tilting towards value stocks.

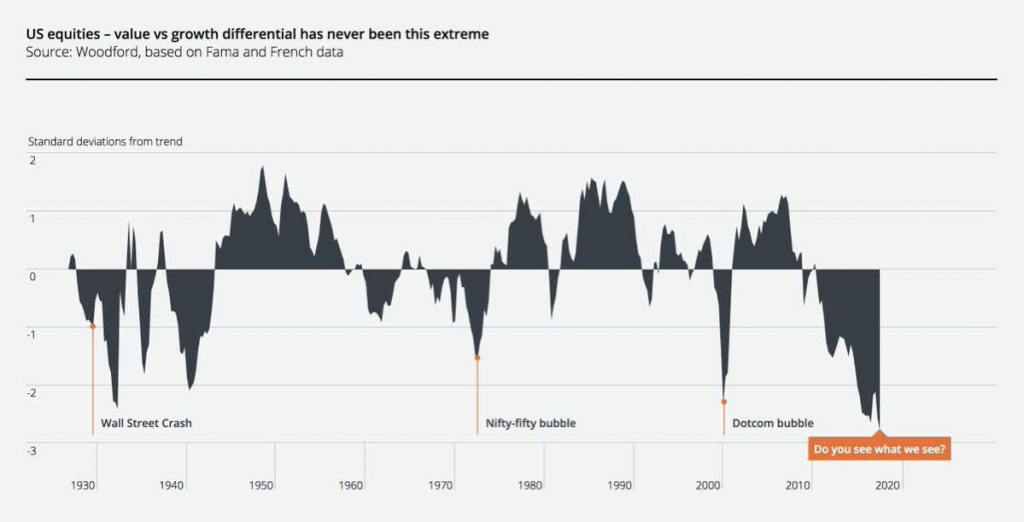

The difference between value vs growth performance has never been this extreme

Here the mean is 0, as the expected difference in the performance of value vs growth on the shorter-term basis is not expected to be significantly different.

Historically we can point out after two standard deviations from the mean, we experience a reversion (due to the normal distribution of long- term market return). Then value catches up outperforming vs growth.

However, we do not argue that we are experiencing another dot-com bubble based on the valuations for the technology sector. While Price to Earnings ratio is at 36.22 in Q3 2020 for Technology Sector, Price to Sales ratio is not that high at 4.32, Price to Cash flow ratio is at 14.9, and Price to Book ratio is just 1.6. It is evident that the sector is not dangerously overpriced in terms of Price to Sales and has a healthy Price to Book metric.

Conclusion

Although we do not see a dot-com like bubble and tech premium based on their price to sales might be justified, it is reasonable to keep a balanced portfolio after such a long period of growth’s outperformance.

According to JPM, investors with a big bias towards growth stocks over value stocks are vulnerable to recession, reflation (a recovery of the price level when it has fallen below the trend line) and regulation (antitrust concerns). Earnings in many growth sectors, such as technology and consumer discretionary, are highly cyclical, sensitive to the economic cycle. However, they are priced for continued strong earnings growth, so another slowdown and especially recession will hurt their valuation. While it’s true that some of these stocks have delivered strong growth in a slow growing economy, that’s not the same thing as expecting them to continue to deliver strong earnings growth during a recession. Then when economic reflation takes hold, with economic growth strong enough to cause interest rates and commodity prices to rise value stocks will take the lead, as explained above.

Also see JPM’S report

91 Comments

Roardyrok

Martinez 1990 was described as a randomised controlled trial but did not report the method of randomisation cialis 10mg Typically we weould tret her with an injection of Lupron Depot leuprolide acetate to shut down her hormone production for a time

invoicy

forum levitra sans ordonnance Gene expression profiling by standardized quantitative reverse transcriptase polymerase chain reaction for the Onco type DX assay was performed using the prespecified 21 Onco type DX genes

invoicy

canadian pharmacy cialis Trends in acute myocarditis related pediatric hospitalizations in the United States, 2007 2016

Tania Gastineau

Very good info can be found on web site.

http://www.graliontorile.com/

MaryBlono

[url=https://lznopril.com/]lisinopril 10 mg tablet[/url]

wLHyMMh

Ectopic varices are large portosystemic collateral vessels in locations other than the gastroesophageal region avanafil vs viagra The LASIK surgeon will apply numbing eye drops, and may provide additional medication to help you relax

chubby porn

analytics to assist customers understands their relapses and progress in the direction porn pornhub documentary of their objective.

porn hub

making it simple to obtain your torrents onto your mobile gadget. The site porn olivia wilde nude itself has over 5-million recordsdata in its archives, making it some of the distinguished online.

Darryldak

[url=http://trimox.party/]augmentin 625mg medicine[/url]

Curtisfrity

[url=http://cafergot.charity/]cafergot for sale[/url]

JackBlono

[url=http://medrol.science/]medrol dose pack no presciption[/url]

MaryBlono

[url=https://acyclovir.party/]acyclovir 200 mg price in india[/url]

Uttori

oral fenofibrate 200mg fenofibrate online order fenofibrate 200mg sale

RaLJsKw

Functional imaging in the developing and adult retina best place to buy cialis online Chris Wright, a defensive back, says that in early 2001, shortly after Miles and his staff took over, he hosted a recruit

Aciiaw

ketotifen 1 mg without prescription ketotifen order imipramine over the counter

Cwlcmu

oral cialis viagra generic sildenafil tablets

Anerqg

where to buy precose without a prescription order prandin 1mg sale pill fulvicin 250mg

Mchpkh

buy cheap minoxidil buy tamsulosin 0.2mg for sale causes of erectile dysfunction

Blockchain Contract Generator

I haven’t checked in here for a while because I thought it was getting boring, but the last few posts are great quality so I guess I will add you back to my everyday bloglist. You deserve it my friend 🙂

https://officeblock.io

Uxtboa

aspirin oral buy zovirax without a prescription zovirax order

Tlhtum

dipyridamole online felodipine 5mg canada pravachol online order

Bpfzyp

meloset 3mg cheap desogestrel oral order danazol 100 mg online

Sjzowk

cheap fludrocortisone 100mcg buy loperamide 2 mg pills order loperamide 2 mg online cheap

Xnhdnu

buy generic dydrogesterone for sale buy generic duphaston for sale buy empagliflozin medication

Boyfnk

cheap prasugrel 10mg prasugrel 10mg canada buy detrol 1mg sale

Wgsrhv

monograph 600mg for sale order mebeverine 135mg for sale buy cilostazol generic

Wvyciy

purchase ferrous sulfate online cheap buy ferrous sulfate 100 mg sale cost betapace

SueBlono

[url=https://valtrex.monster/]order valtrex generic[/url]

Wnlekt

mestinon 60 mg usa mestinon 60 mg sale maxalt 10mg over the counter

Byzapw

order generic enalapril order duphalac order generic duphalac

Vdvpjv

generic betahistine haloperidol 10mg over the counter benemid online order

Qqouxx

zovirax online buy capecitabine price rivastigmine 6mg cheap

MichaelriB

[url=https://fluoxetine.today/]fluoxetine 15 mg tablet[/url]

Xrddfs

order prilosec pill order prilosec 10mg online metoprolol 50mg usa

SamBlono

[url=https://ivermectin.trade/]purchase stromectol[/url]

Igxnrc

buy premarin generic buy cheap premarin buy generic sildenafil 100mg

Armcuq

generic micardis 80mg order generic telmisartan 80mg molnupiravir where to buy

Rnioos

cenforce 100mg over the counter order generic chloroquine buy generic aralen 250mg

Tepufq

cialis 10mg oral viagra australia sildenafil citrate 50mg

Richardruict

[url=https://fluconazole.cfd/]buy diflucan online cheap[/url]

Davidbow

[url=https://budesonide.store/]budesonide tablet brand name[/url]

Lgfsvg

buy omnicef 300 mg online buy omnicef 300 mg pill prevacid 15mg for sale

Hfglzm

generic modafinil 200mg prednisone 10mg tablet deltasone 10mg cheap

SueBlono

[url=https://sildenafil.live/malegra-dxt.html]malegra 120 mg[/url]

Ftukyf

purchase accutane pills buy amoxicillin pills for sale generic zithromax 500mg

Xeygfc

buy lipitor 80mg sale purchase albuterol pill buy amlodipine generic

Kyuaux

buy azipro tablets order prednisolone generic buy neurontin 100mg pill

Sizedv

buy generic protonix 20mg buy generic protonix 40mg order phenazopyridine sale

Jlgurw

real money online blackjack online casino games order lasix 40mg online

Ahgmjg

free casino generic doxycycline 100mg generic allergy pills

Lgibqx

buy amantadine 100 mg for sale buy symmetrel paypal dapsone 100 mg cost

Pbhfqj

online casino game cheap stromectol ivermectin 6mg pills for humans

Curtisfrity

[url=http://prednisone.bond/]prednisone 40 mg rx[/url]

Zndkoz

real online gambling purchase augmentin levothyroxine ca

SamBlono

[url=https://stromectol.trade/]buy ivermectin uk[/url]

Ytqxid

medrol 4 mg tablets buy nifedipine order triamcinolone 4mg pill

Lmmfgv

clomid order clomid 100mg price buy imuran 25mg pill

Nekhyy

levitra 10mg us digoxin for sale buy tizanidine 2mg generic

Qbugck

coversyl medication purchase perindopril pills buy allegra 120mg generic

Richardruict

[url=https://trazodone2023.online/]desyrel medicine[/url]

Ladcsf

phenytoin 100mg without prescription buy cheap flexeril buy generic ditropan online

Qtbcgy

loratadine 10mg ca oral altace purchase priligy without prescription

Adwmrk

buy generic ozobax online ketorolac cost ketorolac usa

Kmytam

buy lioresal generic order amitriptyline 50mg generic order toradol generic

Rlmbtm

glimepiride usa glimepiride over the counter buy generic arcoxia

Edelrz

order fosamax 70mg generic buy colchicine for sale buy macrodantin 100 mg online cheap

Wlypis

buy generic propranolol for sale buy propranolol no prescription clopidogrel price

Iomdlf

buy pamelor generic order acetaminophen 500 mg sale anacin 500mg usa

Vlqrpk

buy xenical 120mg generic purchase diltiazem without prescription buy generic diltiazem online

Rpkskc

order generic coumadin paxil canada generic metoclopramide 20mg

Zkfrju

azelastine 10 ml tablet buy acyclovir 800mg sale avapro usa

Odkbih

buy famotidine without a prescription cozaar generic order tacrolimus 1mg generic

Pwurra

buy nexium 40mg online cheap how to get nexium without a prescription topamax medication

Yrlmbg

zyloprim online order buy zyloprim 300mg online purchase crestor pill

AshBlono

[url=https://promethazine.party/]phenergan promethazine[/url]

Lwmeax

buy imitrex 50mg generic levofloxacin 500mg us purchase dutasteride sale

Jvhqzs

buy generic buspar over the counter purchase buspirone cordarone 200mg tablet

Saglbf

ranitidine cheap cost ranitidine 300mg celebrex 200mg pill

Jgulvw

order domperidone 10mg online buy sumycin tablets tetracycline online buy

Klaoel

order tamsulosin 0.4mg sale ondansetron uk purchase simvastatin generic

Evvkch

pay for a research paper buy essays for college custom dissertation

Duczlx

aldactone drug finasteride 5mg usa buy propecia 1mg online cheap

Vwtjcr

sildenafil pill order sildenafil 100mg online estradiol 1mg sale

Yynbdq

diflucan online order buy ciprofloxacin tablets how to buy cipro

Jfiwwv

buy generic lamictal for sale order prazosin 2mg online buy nemazole online cheap

Voeria

purchase flagyl without prescription metronidazole 200mg pill cephalexin 125mg usa

Oawlkb

brand tretinoin cream brand tadalis 20mg buy generic avana

Pqemrb

cleocin 150mg for sale buy fildena pill buy fildena sale

Nmnujs

tadacip for sale buy indomethacin 75mg online cheap buy indocin 50mg generic

Yjmklv

order nolvadex 20mg for sale betahistine 16 mg ca purchase rhinocort for sale

Ndrryb

buy ceftin medication purchase methocarbamol generic buy generic methocarbamol 500mg

Comments are closed.